An Interview with GoldCore Founder, Mark O’Byrne

“Uber-bull predictions of gold at over $5,000 per ounce are not beyond the realms of possibility…”

So says GoldCore founder and self-confessed gold bug, Mark O’Byrne.

Indeed, I recently caught up with Mark to get his thoughts on gold and what’s going on with it right now…

But before we got to the nitty-gritty, I started by asking him a little about his background:

GLENN: How long have you been in the gold business, Mark?

MARK: Well, I founded GoldCore more than 14 years ago and it’s been my passion and a huge part of my life ever since.

I strongly believe that due to the significant macroeconomic and geopolitical risks of today, saving and investing a portion of one’s wealth in gold bullion is prudent.

Indeed, I believe it will reward patient investors again in the coming years.

GLENN: Interesting… and I want to dig into your views on where you see gold going in a moment. First, though, for those who don’t know about GoldCore, can you tell us a little about what you do?

MARK: Sure. Basically, my passion is helping people to protect and grow their wealth with the provision of the safest forms of precious metals ownership – allocated and segregated physical gold, silver, platinum and palladium bullion coins and bars.

GLENN: And that ownership is key, right, as far as you’re concerned?

MARK: Definitely. We believe actual outright legal ownership of physical coins and bars is vital, rather than owning digital and paper gold.

We now have over 15,000 clients in over 140 countries with over $130 million in bullion assets under management & storage.

We completed the sale of our wealth management division in 2015 to focus on our core business. A major milestone of sales of over $1 billion was reached in September and it’s our next corporate goal to help our clients own $1 billion worth of coins and bars stored through us in the safest vaults in the world.

GLENN: Those are some big numbers – well done.

MARK: Thanks. It’s great to be moving in the right direction and you know I have long endeavoured to educate our clients and the wider public about our modern monetary and financial system and how a precious metals diversification remains an important way to grow wealth in today’s uncertain world.

Today, I am concerned that we have not learnt our lessons, we are repeating the same mistakes as before and there will be similar negative consequences for the unprepared.

So, the more we can help people protect themselves with physical gold, the better as far as I’m concerned.

GLENN: Makes sense. And obviously, you’re a major gold bull… but let me ask you, as I’m sure many other would ask the same: why do you think gold makes a good investment?

MARK: Well, that’s the question isn’t it?

Put it this way…

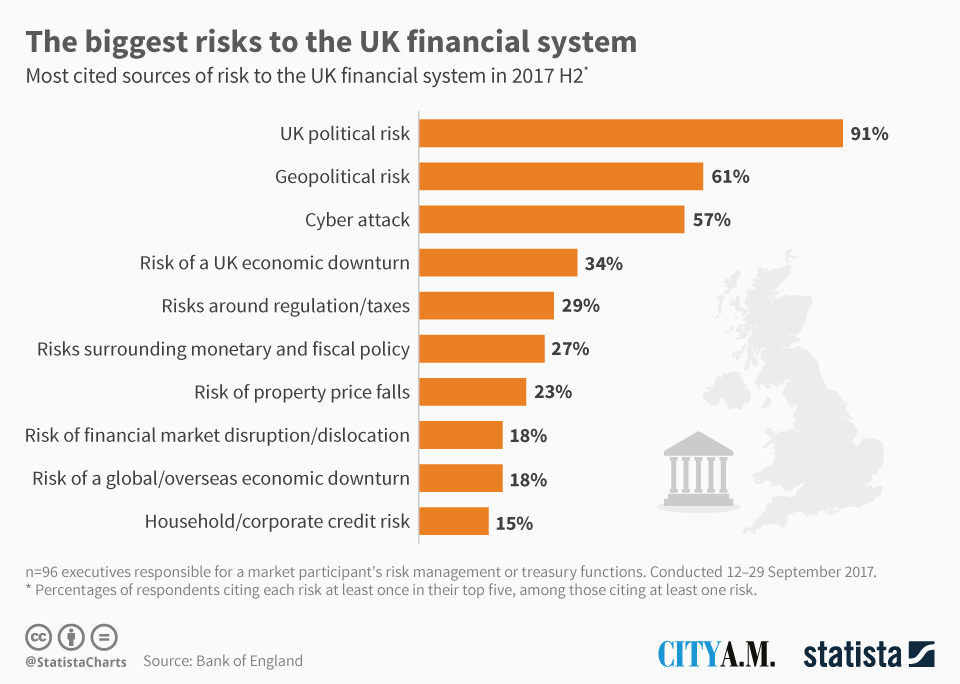

We live in a world beset by risks – Brexit, Trump, North Korea and major central banks, including the Bank of England, are all engaged in a gigantic monetary experiment.

Fact is, the UK – and most other country’s economic recoveries remain very fragile.

But gold is a proven safe haven asset and acts as a hedge against a fall in stocks and property and against currency devaluation. This was seen during the global financial crisis.

And it was the same for those with sterling exposure after Brexit, when gold rose 30% in sterling terms last year.

GLENN: In other words, over the long term gold has performed well?

MARK: Exactly. Since GoldCore was established in 2003, gold has seen average gains of over 12% per annum in British pound terms. I think that makes it pretty good investment.

GLENN: Indeed, here’s the thing, though… for a while now gold seems to have been underperforming. Many commentators suggest the gold price should be much higher right now? Do you agree?

MARK: Yes I do.

We believe gold will reach a new inflation adjusted high over $2,500 per ounce in the coming years.

Indeed, uber-bull predictions of gold at over $5,000 per ounce are not beyond the realms of possibility given the scale of the coming global debt crisis and the magnitude of the geo-political risks facing us.

GLENN: Hmm. That is very interesting. What do you think could be the next catalyst for a significant rise in the gold price?

MARK: For me it has to be geopolitics and the supply demand fundamentals…

We are on the cusp of peak gold production.

Gold production is South Africa has already fallen over 75% and it is the canary in the gold mine so to speak.

All the data is suggesting this and leading people in gold mining industry itself to say we are on the verge of peak gold.

GLENN: That’s interesting you mention mining there… I’m currently working on a project with our in-house gold mining expert all about an area in British Columbia called ’The Golden Triangle’… are you familiar with it?

MARK: Yeah, a little. I’m aware that there sizeable gold deposits in the area and that they are seeing a lot of exploration and increased mining.

Canada is interesting from a gold supply perspective as it is the 5th largest gold producer, after China, Australia, Russia and the U.S.

Arguably given its size and the inaccessibility of many of the mines, Canada likely has to best potential for an increase in gold production.

This supply will be needed to meet global demand as global gold production faces the challenge of peak gold production.

[Editor’s note: This backs up exactly what Simon Popple has been writing about in a new report he’s preparing right now. I’ll be in touch with more details on this as soon as it’s ready.]

GLENN: Great. I’m glad an expert like yourself is hearing the same things we are and I must thank you for all you’ve shared today. I think our readers will find it really interesting to get your view.

Before I let you go, though… before we started talking properly, I mentioned I saw a piece recently suggesting cryptocurrencies are now ‘the new gold’ when it comes to a safe haven asset and you, shall we say, smirked somewhat. What are your thoughts on that and cryptocurrencies generally?

MARK: Look, Bitcoin and cryptos generally, are very interesting and we were actually one of the first bullion dealers and wealth managers to write about them. We were even on CNBC back in 2015 discussing them.

And to be frank, the fledgling digital currency and the technology behind Bitcoin itself is exciting and has potential.

However, it has become massively speculative and has the hallmarks of a bubble after its meteoric 6-fold increase in the last year.

Coinbase, a leading bitcoin exchange saw 100,000 accounts opened in just 24 hours on November 1st, as reported by Bloomberg. In my opinion, Bitcoin is significantly overvalued in the short term.

Conversely, gold appears undervalued as it is flat to mildly higher this year and appears to be consolidating on last year’s gains.

It is important to think of gold in local currency terms. Gold is trading at just below £1,000 per ounce and is still 16% below its record nominal high of £1,160 per ounce in August 2011 and the height of the global financial crisis.

So, gold looks good value versus stocks, bonds and many property markets (especially London) – many of which are at all-time record highs and look overvalued. We are advising clients to rebalance portfolios.

GLENN: Great. Thanks again for taking the time to share your thoughts with our readers, Mark. It’s much appreciated.

Indeed, if people would like to find out more about Mark and what he and the team are GoldCore are up to, you can visit www.goldcore.com.

News and Commentary

Gold volatility ‘breakout’ coming soon to ‘eerily quiet’ market – Metals Expert (CNBC.com)

Gold inches up as dollar weakens after U.S. Senate tax bill stalls (Reuters)

Dollar Dips as Tax Bill Hits Snag; Stocks Decline: Markets Wrap (Bloomberg.com)

U.S. Mint American Eagle gold, silver coin sales fall sharply (Reuters)

Turkish gold trader implicates Erdogan in Iran money laundering (Reuters)

“There will be pain”: Bank of England’s Carney warns against no deal Brexit (City AM)

Chance of US stock market correction now at 70 percent: Vanguard Group (CNBC)

4 habits that will make you poor (SBCH)

How central banks paved the way for bitcoin’s birth (MoneyWeek)

Sharia-compliant gold standard – Response from Muslim investors has been positive (The National )

Gold Prices (LBMA AM)

01 Dec: USD 1,277.25, GBP 946.57 & EUR 1,072.51 per ounce

30 Nov: USD 1,282.15, GBP 952.64 & EUR 1,084.06 per ounce

29 Nov: USD 1,294.85, GBP 965.70 & EUR 1,092.46 per ounce

28 Nov: USD 1,293.90, GBP 972.75 & EUR 1,088.95 per ounce

27 Nov: USD 1,294.70, GBP 969.73 & EUR 1,084.83 per ounce

24 Nov: USD 1,289.15, GBP 967.89 & EUR 1,086.37 per ounce

23 Nov: USD 1,290.15, GBP 969.93 & EUR 1,089.40 per ounce

Silver Prices (LBMA)

01 Dec: USD 16.42, GBP 12.16 & EUR 13.80 per ounce

30 Nov: USD 16.57, GBP 12.32 & EUR 14.00 per ounce

29 Nov: USD 16.90, GBP 12.60 & EUR 14.26 per ounce

28 Nov: USD 17.07, GBP 12.84 & EUR 14.36 per ounce

27 Nov: USD 17.10, GBP 12.81 & EUR 14.32 per ounce

24 Nov: USD 17.05, GBP 12.80 & EUR 14.38 per ounce

23 Nov: USD 17.10, GBP 12.84 & EUR 14.43 per ounce

Recent Market Updates

– Low Cost Gold In The Age Of QE, AI, Trump and War

– Own Gold Bullion To “Support National Security” – Russian Central Bank

– Bitcoin $10,000 – Huge Volatility of Cryptocurrencies and Risky Fiat Making Gold Attractive

– Financial Advice from Dr Wayne Dyer

– Buy Gold As Fed Shows Uncertainty And Concern Over Financial ‘Imbalances’

– Brexit Budget – Grim Outlook As UK Economy Downgraded

– Geopolitical Risk Highest “In Four Decades” – Gold Demand in Germany and Globally to Remain Robust

– Gold Versus Bitcoin: The Pro-Gold Argument Takes Shape

– Money and Markets Infographic Shows Silver Most Undervalued Asset

– Is New Fed Chief A “Swamp Critter Extraordinaire”?

– Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe

– UK Debt Crisis Is Here – Consumer Spending, Employment and Sterling Fall While Inflation Takes Off

– Protect Your Savings With Gold: ECB Propose End To Deposit Protection

Related Reading

Puerto Rico Without Electricity, Wifi, ATMs Shows Importance of Cash, Gold and Silver

Massive Equifax Hack Shows Cyber Risk to Deposits and Investments Today

Internet Shutdowns Show Risk of Digital Gold Platforms

Yahoo Hacking Highlights Cyber Risk and Increasing Importance of Physical Gold

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.