GoldSaver

GOLDSAVER

The Solid Gold Alternative to

Traditional Savings Accounts

Saving money in a traditional savings account may soon mean that you will no longer earn interest but instead pay for this privilege by having a negative interest rate charged to your account!

- In addition to this, some forecasters are expecting an increase in inflation, which could mean that your savings have less purchasing power over time.

- These two factors are making traditional savings accounts less and less attractive.

- Owning gold has historically been seen as a protection against inflation and also performs well during times of low or negative interest rates, making it an ideal solution in these times.

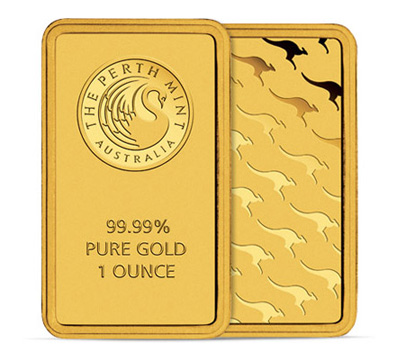

- However, the price of an ounce of gold whether it’s a gold bar or a gold coin has meant that it wasn’t a suitable alternative for a regular savings plan for most people.

Are you concerned about the impact that inflation and negative interest rates will have on your hard-earned savings?

3 reasons why you should open a GoldSaver account today

- Safe- 100% Backed by Physical Investment Grade Gold Bullion

- Secure- Gold is Stored in High-Security Vaults

- Affordable - From a minimum of $/£/€100 Per Month

With a GoldSaver account you can invest in physical gold even in very small amounts. Because this is done monthly, it allows for euro-cost-averaging; that is, making a series of smaller investments over a set schedule rather than paying a lump sum up front.

In doing so, you avoid the impact of market volatility and gain a preferable average price for your investment.

How A GoldSaver Account Works

As the first gold accumulation program in Ireland, the GoldSaver account is the safest way to save and buy gold bullion.

Saving money in a traditional savings account will soon mean that you will no longer earn interest but instead pay for this privilege by having a negative interest rate charged to your account!

In addition to this, some forecasters are expecting an increase in inflation, which could mean that your savings have less purchasing power over time.

These two factors are making traditional savings accounts less and less attractive.

Owning gold has historically been seen as a protection against inflation and also performs well during times of low or negative interest rates, making it an ideal solution in these times.

However, the price of an ounce of gold whether it’s a gold bar or a gold coin has meant that it wasn’t a suitable alternative for a regular savings plan for most people.

GoldSaver, Ireland’s first and only gold accumulation programme.

-

-

GoldSaver allows you to purchase physical gold starting from as little as €100 per month.

-

GoldCore purchases physical gold for you and stores it on your behalf in High-Security Vaults

-

A GoldSaver account sees your gold holdings build up over time in a highly efficient, safe and secure way. All savers can benefit from owning gold, something that was previously only afforded to larger investors.

As a GoldSaver Account Holder you have 2 main options

You can either…

1. Deposit a fixed sum of money monthly via standing order. This will then be allocated to your gold holdings.

OR

2. Deposit a fixed sum of money monthly via your credit or debit card. This will then be allocated to your gold holdings.

(at any time you can make additional lump sum contributions).

Thereafter, GoldCore credits the gold ounces purchased to your individual account, which can be accessed through our highly secure, password-protected, online system.

This means you can view all current and historic trades along with valuations of your gold holdings any time you like.

As the first gold accumulation program in Ireland, the GoldSaver account is the safest way to save gold bullion.

Open your account today to start saving. It's easy.

Simply click "open account" and choose your monthly sum.

Benefits of a

GoldSaver Account

With a GoldSaver account you can invest in physical gold even in very small amounts.

Because this is done monthly, it allows for dollar-cost-averaging; that is, making a series of smaller investments over a set schedule rather than paying a lump sum up front.

In so doing, you avoid the impact of market volatility and gain a preferable average price for your investment.

This process is an effective safeguard against the dangers of saving in banks and building societies.

With inflation and negative interest rates, savings that are held in these establishments are worth less over time.

In short, opening a GoldSaver account makes your savings more solid.

But wait, there's more.

A lot more!

Other benefits of opening a GoldSaver account are:

- Very Low Cost - Pay just 5% premium when you buy and 1% when you sell. Annual management charge is 1%.

- Convert to Physical - After 12 months, or when you accumulate 10 oz, you can convert into coins for delivery. Fees apply.

- Lump Sums Accepted - You can add a lump sum to your GoldSaver account whenever you like. This way you can build up your balance and arrive at your target investment balance sooner.

- Security - 100% of your gold is held in high-security professional vaults. Every ounce is fully allocated and real. It is never leased or based on derivative contracts.

- Trusted provider - Operated by GoldCore, a provider with 15,000 clients and managing $150 million in assets in 75 countries.

- Trial period - There is a 15-day cooling-off period during, in which you can cancel your account without penalty.

- Easy and convenient - Sign up in 3 minutes with your credit or debit card and start increasing your wealth today.

Set up an account and start growing your investments.

The allure of gold – its purity, rarity, honesty – has compelled people to own the precious metal for millennia. Owning precious metals is insurance against the debasement and devaluation of your savings. A professional bullion dealer like GoldCore is your gatekeeper.

What the Personal Finance Experts Say…

"The allure of gold – its purity, rarity, honesty –compelled people to own the precious metal for millennia. Owning precious metals is insurance against the debasement and devaluatin of your savings. A professional bullion dealer like GoldCore is your gatekeeper."

"GoldCore has always been my top choice when it comes to precious metals. They have the best storage programme of any provider that I know of. I have referred my clients to them for many years and their professionalism and efficiency shines brightly like the metals they deal in."

How to Open a GoldSaver Account

1. Click on the ‘Open Account’ button.

- Fill in your personal details and choose how much you would like to start saving per month.

- Next enter your payment details. The minimum saving term is 12 months. Payments from your card or bank will be made on the 2nd day of every month and invested in the gold market between the 6th and 8th day of the same month.

2. Scan your ID and application form.

- By law, we are obligated to identify our clients. It is a straightforward process that only needs to be completed once.

- We will need the account owner or operator’s proof of identity (passport copy or driver’s license) and proof of residency (a utility bill or bank statement dated within the last 6 months).

- Then simply upload the scanned or photographed documents through our secure system.

Client Testimonials

My only regret about the GoldCore GoldSaver plan is that I didn't sign onto it much earlier. Making regular investments in gold could not be easier. There isn't much to say about the individual transactions because they're so transparent as to be practically unnoticeable.

- Roy McCoy

GoldSaver provides an excellent way for long term savers to hedge against deposit account negative interest rates & inflation.

- Eoghain Mac Carthaigh

I enrolled in GoldCore's Gold Saver account about 16 months ago. The peace of mind that I get, knowing that my position in gold will consistently grow every month, is tremendous. You can set your monthly purchase as low as $100 on up to whatever you want. I set my pledge kind of low just in case something happens where a large commitment would really hurt. If you want more than what you have pledged, you can add to that months purchase very easily online. It's a great program for anyone interested in building a position in gold each and every month. I feel that everyone should have the protection against inflation that gold provides.

- Daniel, Mary and Carlee Nestrud

How Can I Save In Gold?

As the first gold accumulation program in Ireland, the GoldSaver account is the safest way to save and buy gold bullion.

With rising inflation and a troublesome banking system, it is increasingly becoming the case that traditional savings accounts are less attractive than they were in the past.

What has consistently remained the same throughout time, is the protection that physical gold offers against inflation, not to mention its performance during financial and geopolitical crises.

However, whilst gold investment has long been a source of interest for many, the price of an ounce of gold, whether it’s a gold bullion bar or a gold coin, has meant that it wasn’t an affordable alternative for a regular savings plan for most people.

Affordable Gold Investment - at your pace

GoldSavers choose a certain amount to be invested in gold on a monthly basis if you have a GoldSaver Account. The minimum fixed monthly investment is €100 which is deducted on a certain day each month from your bank account.

For customers with GoldSaver Accounts, GoldCore makes gold bullion purchases at the London Bullion Market Association (LBMA) AM US dollar gold fixing price.

Access Any Time

Each client's GoldSaver Account is accessed through our secure, password-protected online platform. Your account is credited with the gold ounces that GoldCore acquires according to your GoldSaver plan.

Customers with a GoldSaver Account can access all recent and historical trades as well as assessments of their gold holdings.

Secure savings

Gold for GoldSaver accounts is bought from LBMA-approved refineries and kept in specialised, high-security vaults.

The process of opening an account is simple and quick and you can open an account in just 3 minutes. Please read the Terms & Conditions and FAQs before clicking the link to "Open Account" and following the on-screen steps.

Still want to learn more?

Check out some of our most frequently asked questions below.

Frequently Asked Questions

Q: How Can I Save In Gold?

A: The GoldSaver account is a gold accumulation program. It allows investors and savers in Ireland the opportunity to build up an investment in gold bullion over a period of time by saving in physical gold bullion.

Q: How does the GoldSaver account work?

A: As a GoldSaver account holder you will nominate a sum of money to be invested in gold on a monthly basis. The minimum fixed monthly amount for Irish GoldSaver clients is €100, there is no maximum.

Q: How can I deposit funds in to a GoldSaver Account?

A: Deposits are made by direct debit, credit or debit card each month. Funds are debited in advance of the trade date.

Q: What is the trade date for a GoldSaver Account?

A: The trade date is the date which gold is purchased for GoldSaver accounts and is currently the 6th or the 8th (if the 6th falls on the weekend) day of any given month.

Q: How is the price determined?

A: The London Bullion Market Association (LBMA) AM U.S. dollar gold fixing price is the basis for the GoldSaver monthly purchase, converted to local currency and adjusted for fees and charges.

Q: How can I see how much gold is purchased?

A: GoldSaver clients can view their holdings through our highly secure, password-protected on-line account access.

Q: Are my savings safe?

A: Yes. The gold for GoldSaver accounts is purchased from LBMA approved refineries and Mints and stored in high security, specialised, precious metals vaults.

Q: How much can I save per month?

A: The minimum is €100 per month. There are incremental options for €250 and €500 with no maximum.

Q: Can I make additional deposits?

A: Yes. You can make additional deposits into your GoldSaver account at any time securely online by logging into your account and depositing funds by card or electronic funds transfer.

Q: What if I change my mind?

A: There is a 15-day cooling-off period during which you can contact us to cancel your account without penalty.

GoldSaver – No better way to regularly buy and save gold bullion

Only takes 3 minutes