When “whatever it takes” means confiscation of wealth

One of the reasons people decide to buy gold bullion or add silver coins to their portfolio is because they cannot be devalued. No one can suddenly decide to print more gold or silver! Sadly, this is exactly what happens with currencies around the world. And the last two decades have been prime examples of this. As governments rush to patch up past mistakes, missed warnings and election cycles they resort to creating more money which ultimately leads to higher prices but less value slewing around the system.

The self reinforcing trends of high inflation have become visible to all. Central banks and governments continue to do “whatever it takes” but now it is “whatever it takes” to deflect blame for the rising prices and falling asset prices.

Central Banks Struggling to Contain the Surging Inflation

Eroding wealth is hitting many people on several fronts – surging inflation on goods and services, tanking equity markets, and falling housing prices to name a few.

Yet, governments and central banks claim no responsibility for the economic climate they have created blaming instead Putin for higher food and energy prices, speculators for eroding equity and housing markets, not to mention China for supply chain issues and lower economic activity due to the ongoing zero covid policy lockdowns.

Surging inflation is more than a decade in the making.

In our post on March 4, 2021, Central Banks Will Still Do “Whatever It Takes”! we discussed the then ECB President Mario Draghi’s “whatever it takes” of 2012 to save the Euro – that morphed into the 2021 promise from Rishi Sunak, UK finance minister’s promise of “whatever it takes” to support the British people and businesses through Covid lockdowns.

Governments poured more than $15 trillion of additional support through increased spending and lower taxes in less than two years. Also, central banks printed money on a grand scale to sucked up all the additional debt issued from governments.

Now central banks have conditioned everyone into the perception that they can save and solve problems with the “whatever it takes” promise over the last decade.

Central banks have now pledged “whatever it takes” to get inflation under control. Chair Powell leads the bandwagon jumpers from old ‘transitory inflation’ onto new ‘yes we were wrong last year, but not wrong again this year’.

Central banks have good reason to keep this bandwagon going in circles and not make much progress.

Click Here to Watch The M3 Report

John Maynard Keynes famously said,

“By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.”

Remember governments have trillions in debt to deal with and the fastest way to reduce that debt is to inflate their way out of it.

The other options are to raise taxes or to severely limit spending how many governments have the political will for either of those and if they do, then they are voted out with promises from the new government to reverse the measures put in place.

The decade long excess is at a tipping point!

Download Your Free Guide

The annual economic report released this week by the Bank of International Settlements (BIS) warns that if inflation becomes entrenched in the global economy, then it could become the new normal and very hard to reverse. In other words higher prices lead to higher prices.

The BIS doesn’t think that central banks, including the Fed, are doing enough to bring inflation under control.

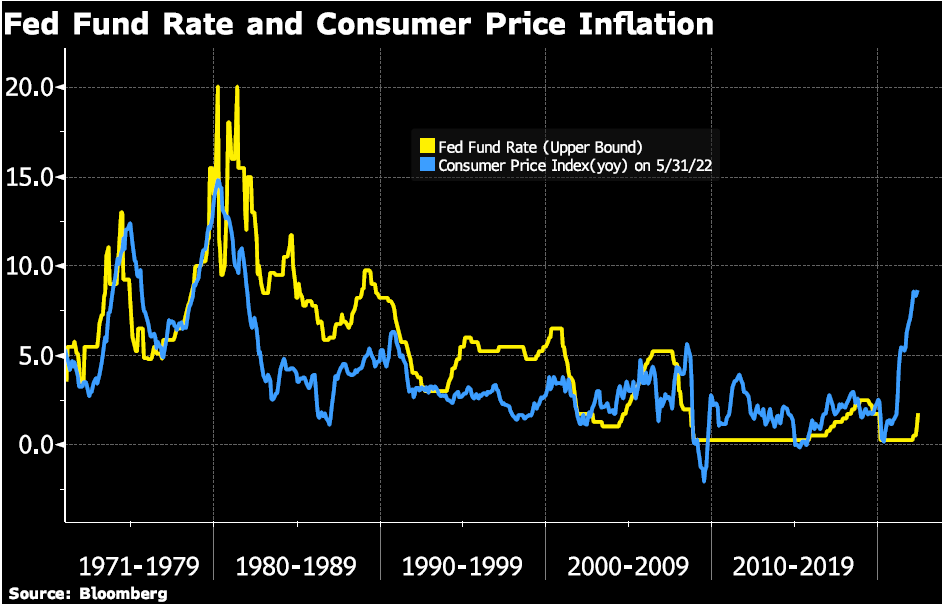

The Fed has raised the fed funds rate rates three times this year for a total increase of 1.5% – but the Fed is still “well behind the inflation curve”. The fed fund rate is in a range of 1.50%-1.75%, while the latest U.S. CPI reading for May came in at a year-over-year increase of 8.6%.

Inflation is Hitting its Tipping Point Warns BIS

From the BIS Report:

In addition to cyclical and structural factors, the level of inflation itself can influence wage- and price-setting. Hence the likelihood and intensity of wage-price spirals. In general, a high-inflation regime, if it persists, induces behavioural changes which raise the probability that it will become entrenched, not least by amplifying the impact of relative price increases.

The report explains: The level of inflation is bound to influence the importance of inflation expectations.

Once the general price level becomes a focus of attention, workers and firms will initially try to make up for the erosion of purchasing power or profit margins that they have already incurred.

This, in and of itself, could trigger wage-price spirals if background conditions are sufficiently favourable. And, once inflation becomes sufficiently high and is expected to persist, they will also try to anticipate future changes in the general price level, as these will erode purchasing power and profit margins before contracts can be renegotiated.

The report goes on to warn that once embedded inflation is very difficult and costly to bring under control and it advises central banks to avoid transitions from low- to high-inflation regimes in the first place – to nip inflation in the bud.

Are we past that point?

The BIS answer: We may be reaching a tipping point, beyond which an inflationary psychology spreads and becomes entrenched. This would mean a major paradigm shift.

How on earth does inflationary psychology spread and become ‘entrenched’? This is something we explored recently on our new show The M3 Report.

Along with our guests Jim Rickards and Gareth Soloway, host Dave Russell explored the idea of perception and asked for how long were politicians going to string us along telling us that all is FINE? I

t seems too regular an occurrence these days to be told that inflation is either temporary or the result of covid, or Putin or someone sneezing.

All whilst we listen from our cars that cost more than ever to refill, or from the kitchen whilst we cook meals that we can barely afford to cook.

But, as Dave and Jim discussed, are perceptions starting to change? Are we now getting wise to the rhetoric?

Here is what you need to know: for commodities like oil – high prices eventually cure high prices. But once inflation sets in for everyone – high prices mean more higher prices because cash cannot be trusted. Physical metals will benefit from inflation becoming embedded.

Bottom line: in a high inflationary environment when the cake becomes smaller, the fight over it becomes bigger!

And what does that paradigm shift look like? Sadly we still haven’t managed to get a hold of that crystal ball so we can’t be too specific.

But, we do know that the world has been through paradigm shifts before. Whether through wars, financial crises or even pandemics (yes, covid isn’t the first).

Every single time people are forced to find their own way to secure their savings and investments.

They find their way to gold and silver, because when governments do ‘whatever it takes’ we should also do ‘whatever it takes’ to reduce the impact of the secret and unobserved theft that is inflation.

Be sure not to miss the brilliant M3 Report! With over 10,000 views in its first week the show has been grabbing everyone’s attention.

From The Trading Desk

Market Update:

Goldman Sachs, the US investment bank has recently raised its year-end price for Gold to $2,500.

The report released this week from the bank noted the second half of the year could bring a recession in the US (or is the US is already in one) which would support a higher Gold price.

They also believe the continued high inflation supports this price.

Goldman’s has said that inflation expectations may become ‘unhinged’ as it has become quite persistent.

Gold is USD terms has held up well, keep in mind we have a stronger USD and higher treasury yields.

These generally have a negative correlation on the price and gold has held up well.

When the USD and Yields cool off, there is only one way for Gold to go.

Maybe it is that will get Gold to these levels that Goldman are looking at for year end.

It is also worth keeping in mind, If Goldman’s have a target of $2,500 for gold, where would that push silver!

Key levels to watch, the psychological $1800 area and main consolidation are at $1,785.

In the bigger picture, these are levels 1-2% below where we are now.

Trying to time it perfectly you can miss the bigger move up, so do consider cost averaging in at these levels.

Stock Update

Silver Britannia offer UK – We have just taken delivery of 10,000 Silver Britannia’s at our London depository.

Available for storage in London or immediate delivery within the UK.

These are available at the lowest premium in the market (which includes VAT at 20%).

These can now be purchased online or contact our trading desk for more information.

Excellent stock and availability on all gold coins and bars. Please contact our trading desk with any questions you may have.

Silver coins are now available for delivery or storage in Ireland and the EU with the lowest premium in the market.

Starting as low as Spot plus 37% for Silver Britannia’s 100oz and 1000oz bars are also available VAT free in Zurich starting at 8% for the 1000oz bars and 12.5% for the 100oz bars.

Buy Gold Coins

GOLD PRICES (USD, GBP & EUR – AM/ PM LBMA Fix)

29-06-2022 1811.85 1817.75 1487.89 1499.64 1723.43 1733.41

28-06-2022 1827.00 1819.05 1488.82 1488.89 1725.97 1727.37

27-06-2022 1838.05 1826.30 1495.81 1486.79 1737.69 1725.49

24-06-2022 1826.50 1825.45 1484.94 1483.54 1730.79 1728.52

23-06-2022 1831.40 1841.90 1500.28 1499.12 1742.94 1746.31

22-06-2022 1827.30 1841.85 1494.37 1501.66 1738.49 1744.97

21-06-2022 1836.50 1840.25 1491.61 1498.33 1736.23 1742.72

20-06-2022 1841.20 1836.50 1502.60 1501.52 1746.75 1745.41

17-06-2022 1849.85 1841.55 1503.74 1506.39 1757.54 1756.47

16-06-2022 1831.55 1826.50 1511.40 1491.15 1758.84 1747.60

Buy gold coins and bars and store them in the safest vaults in Switzerland, London or Singapore with GoldCore.

Learn why Switzerland remains a safe-haven jurisdiction for owning precious metals. Access Our Most Popular Guide, the Essential Guide to Storing Gold in Switzerland here

Receive Our Award Winning Market Updates In Your Inbox – Sign Up Here